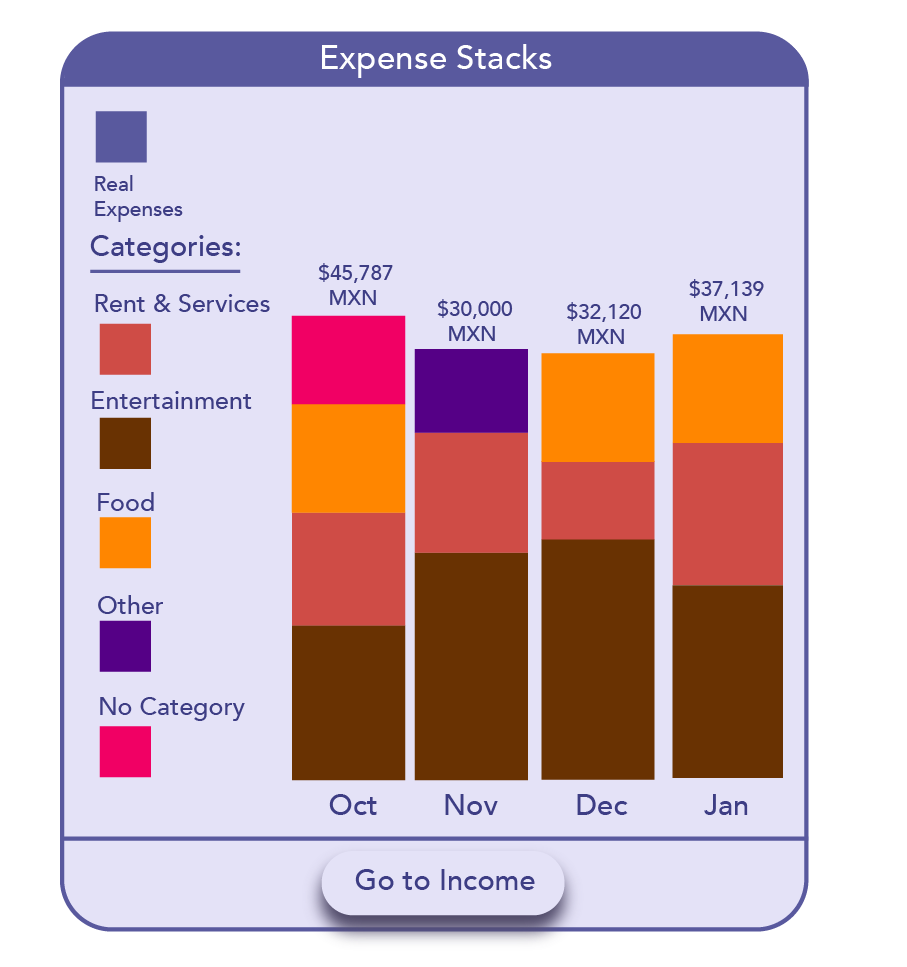

Constantly anxious about upcoming monthly payments? How about getting peace of mind by seeing your contemplated expenses graphically?

Are your contemplated expenses for next month in line with your recurrent ones? Make sure there are no unfortunate surprises with the Expense Stacks.

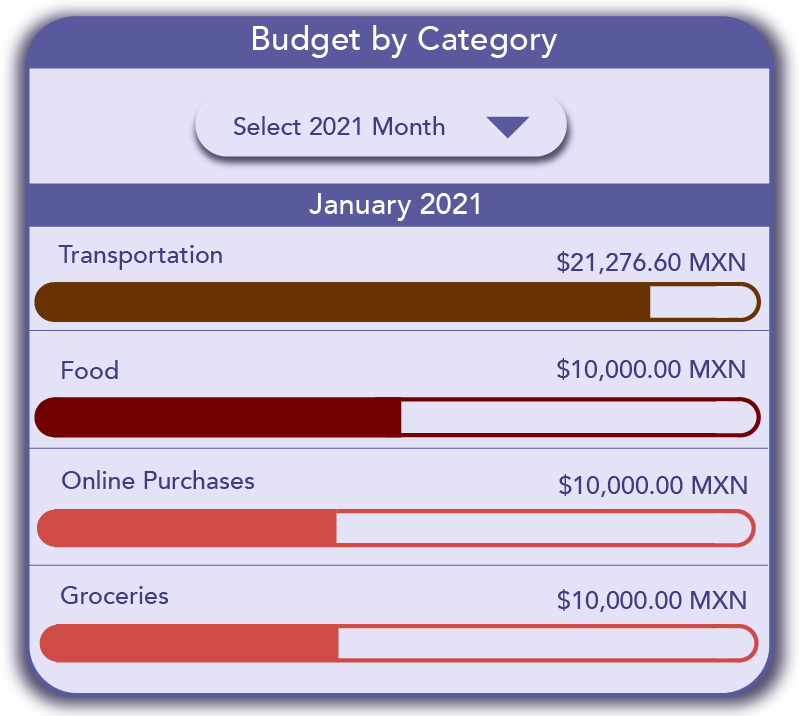

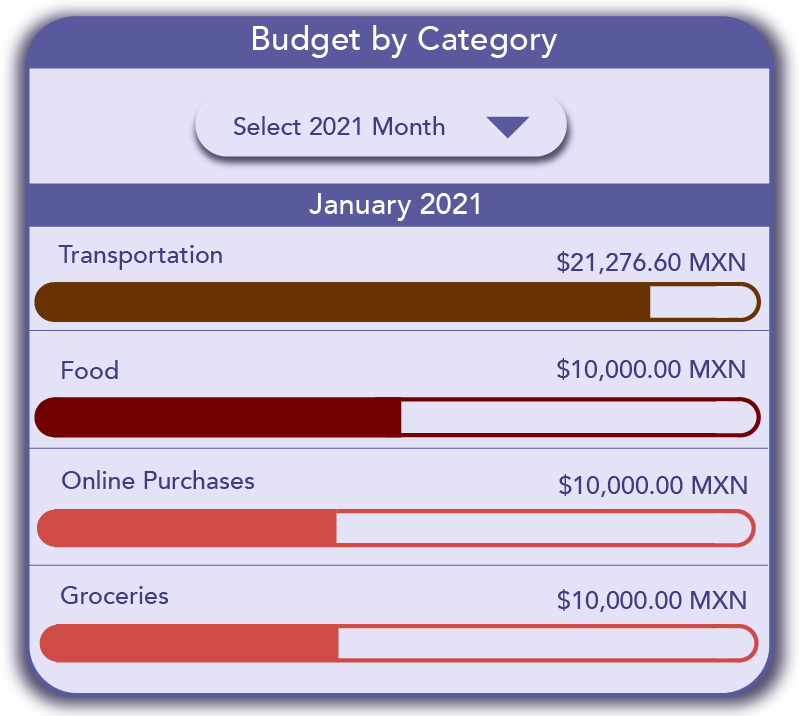

Having continual trouble viewing and assessing your budgets? View your budgets by category by selecting a month of the current year.

Is your assessment of your budgeting correct, and are you able to keep on track with your expenses? Find out with the Budget by Category Widget.

What does your net worth look like on a month-to-month basis? Are you increasing your wealth over time? Find out with the Net Worth widget.

Is your net north increasing or decreasing over time? Are you acquiring more resources over time? Find out with the Net Worth widget.

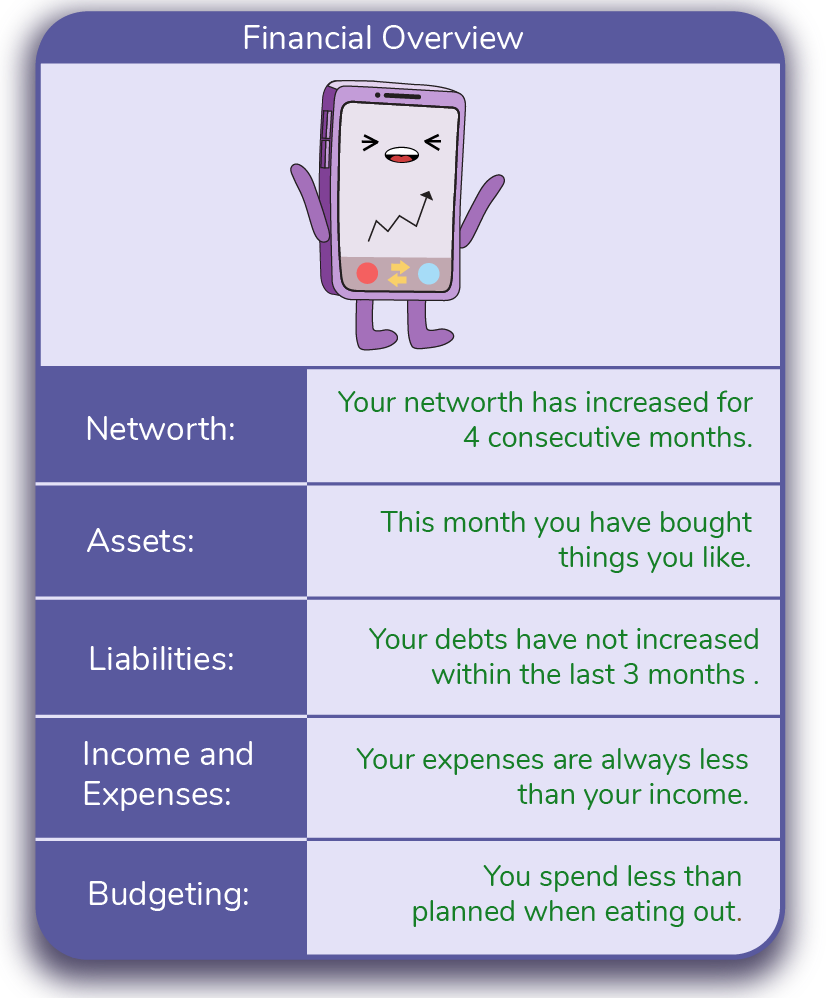

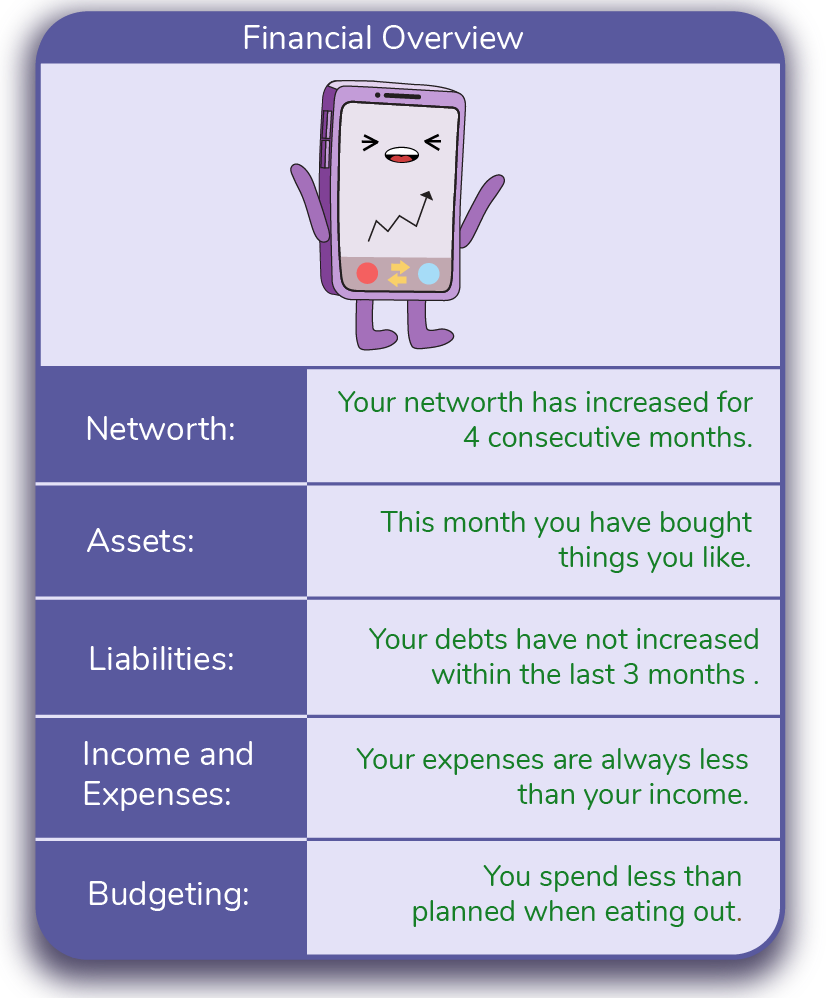

Wish to get an overview of your financial status? Not sure if you are on the right track towards financial freedom? Are you keeping your debt in control? Find out with the Financial Overview Widget.

Earnie's mood will change depending on your current overview, getting increasingly mad for staying out of budget.

How long could you survive without having an income with your current resources? Find out with the Cash Runway Widget.

How many months or years could you live with your current assets? Have you thought about savings for retirement and old age?

Have you ever wondered how your income and expenses relate to each other? Keep track of your daily expenses with the Expense-o-meter widget.

Make sure that your expenses are never exceeding your income with the Expense-o-meter.

Net Worth:

The valuation of all your assets, minus all the debt you owe.

Expense:

This refers to the money that you spend in order to obtain a good or service in return for the money you paid. Some common expenses are rent, dining out, an electricity bill or other utilities. Expenses affect your net worth negatively.

Payee:

The individual or business to which you have or will pay money to. The name of the payee is part of a bill of exchange.

Account Balance:

The total amount of money present in an account at any given moment. For example the total amount of money you owe in your credit card account or the total amount of money you have in your savings account.

Income:

The money that you receive as exchange for a service you have provided to another individual or business. This usually in the form of a salary, on a fixed month-to-month basis. Income affects your net worth positively.

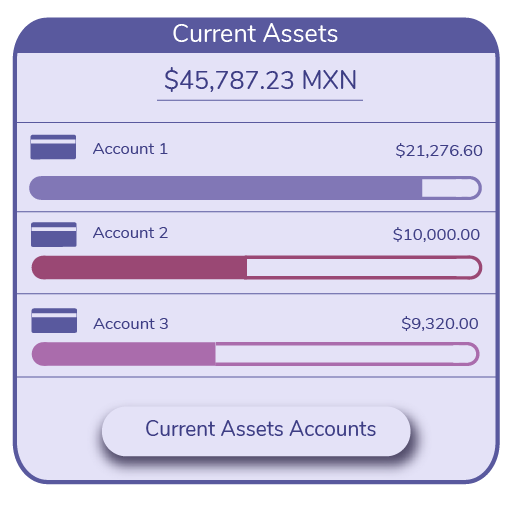

Current Assets:

This refers to physical or electronic cash, or other valuables that can be easily converted to cash.

Fixed Assets:

Property that exists in physical space like a car or a house.

Financial Assets:

Examples of these are stocks, bonds, mutual funds and bank deposits. The worth of these valuables may be based on material property value, but other variables like supply and demand of the market affect their value as well.

Short term Debt:

Examples include credit cards, personal loans, line of credit. A loan is money you have agreed to pay, in several payments with an interest rate.

Long term debt:

Mortgages, home equity loans (which use the value of the house as collateral for payment) and credits that have a payment date in over a year.

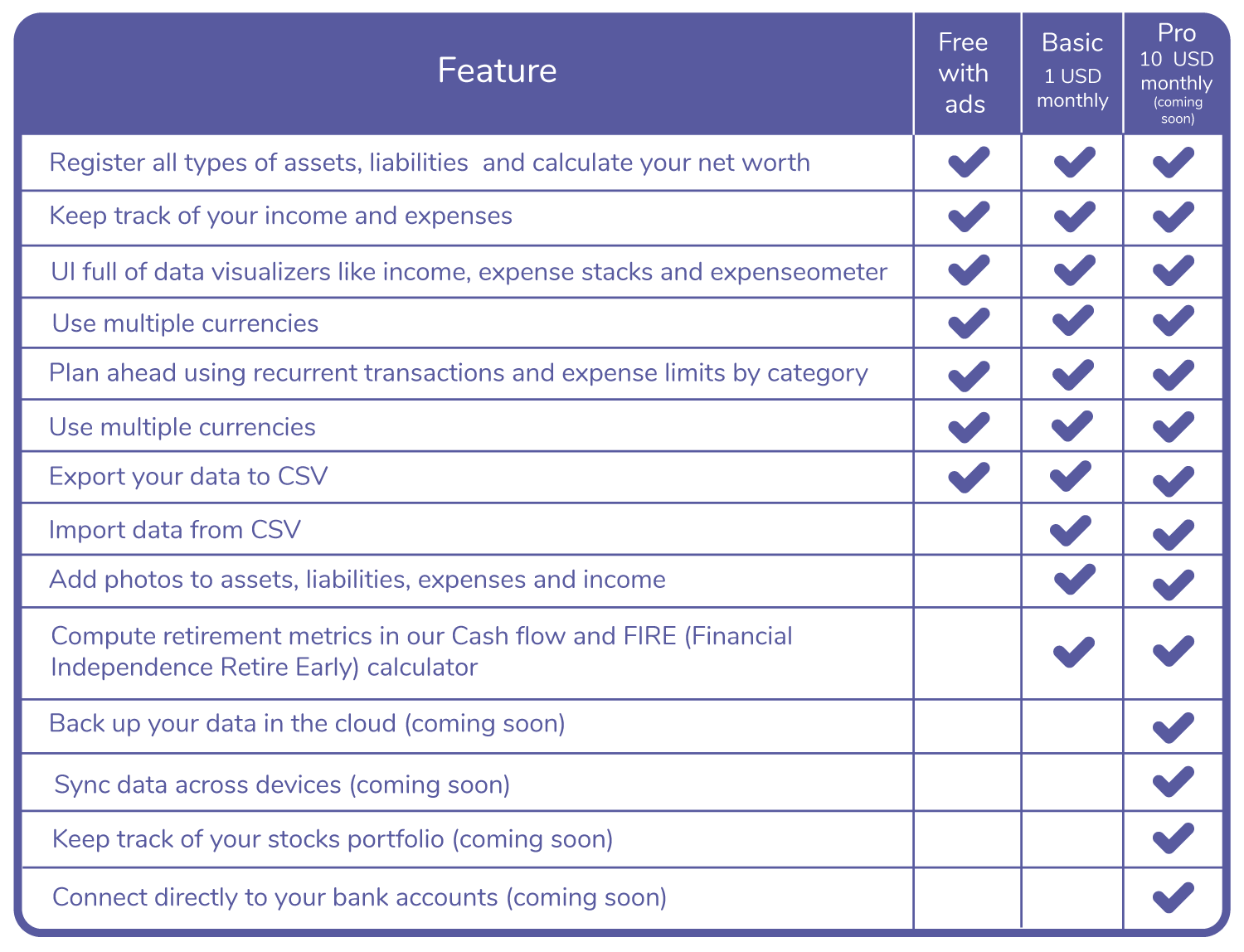

Choose the plan that best suits your needs.

Financial Overview

View the overall state of your personal finances with this simple display widget

Current Assets

View all your current assets and liabilities as in their relative widgets

Expense Stacks

View all your expenses as stacks, color-coded and in their relative month.

Budget by Category

View your budget by category on a month-to-month basis. See if you have exceeded your budgets.

Multi-currency

Change your base currency to various other available options. Your selection is reflected on all accounts.

Identify by Image

Add pictures to your income, expenses, assets and liabilities for reference.

Expense-o-meter

A dial that points to your current daily expense to income relationship.

Net Worth Widget

View your Net Worth over time, on a month-to-month basis.

Cash Runway Widget

View your Cash Runway with the ability of turning on and off certain variables.